If you’re thinking of getting into investment properties in the UK and you want to know how much rental property you can afford, then this post will answer it for you.

You will need at least about 30% of the purchase price of a buy-to-let investment property, where 25% is the deposit and 5% are other costs of purchasing.

This 30% does not include any refurbishment work.

E.g. For a £100,000 property:

If you are planning on buying a £100,000 property in the UK on a buy-to-let interest-only mortgage you’ll want:

- 25% (£25,000) for the deposit

- 5% (£5,000) for other closing costs.

The total upfront purchasing costs would be around £30,000 which is 30% of the £100,000 purchasing price.

Property in the UK is expensive, but don’t worry.

You don’t HAVE to buy £1million houses to get into the property investment game in the UK.

In this post, we’re going to focus on buy-to-let investing in the UK and how much it would cost you to get started investing in UK property.

Let’s start with how buy-to-let investing works.

Buy-To-Let Investing: How It Works In The UK

Buy-to-let investing is where you buy a property, then you let it out to tenants who pay you rent every month.

The tenant rents the property from you (the landlord).

When you buy property in the UK for the purpose of renting it out you can’t use a residential mortgage.

You need to get a special type of mortgage called a buy-to-let mortgage and these vary in cost compared to residential mortgages.

With residential mortgages, you can get away with a higher loan-to-value (LTV) where the lender (the bank) will let you borrow up to 90% – 95% of the home’s value.

In some extreme cases, you can borrow up to 100% of the value of the property.

So you can buy residential properties with 5% or 10% deposits and you’ll get these on repayment mortgages where you pay both the original mortgage amount as well as the interest on top.

But the minimum deposits and loan-to-value requirements of a buy-to-let mortgage are different.

Buy-To-Let Minimum Deposits And Loan To Value

With a buy-to-let mortgage, the typical minimum deposit that you would need is 25%, and you would normally get this on an interest-only mortgage.

On an interest-only mortgage, you only pay the interest of the mortgage but not the original mortgage amount.

This means your percentage of equity in the property won’t change on an interest-only mortgage.

- You can work out your payments using this interest-only mortgage payment calculator.

- You can look at current interest rates for buy-to-let mortgages at MoneyFactsCompare.co.uk

By putting down a deposit of 25% it means that your loan to value is 75% and most buy-to-let lenders will use this as their minimum requirement.

In some cases, you can find buy-to-let mortgages that are 80% loan-to-value where you put down a 20% deposit, but these are less common.

- If you’re unsure about LTV then you can use this loan to value calculator

And you can put a higher deposit down if you wish, but 25% is the standard that most property investors will use because it lets them leverage their money more.

Related reading: 25% or 30% deposit for buy-to-let? Compared

Here are 2 examples of buying a property using a buy-to-let mortgage with a 25% deposit and a 75% loan to value.

Example 1: £400k 💰💰💰

- Property price: £400,000

- Deposit required £100,000 (25% of £400,000)

- Mortgage amount: £300,000 (75% of £400,000)

Example 2: 💰

- Property Price: £100,000

- Deposit required: £25,000 (25% of £100,000)

- Mortgage amount £75,000 (75% of £100,000)

So to summarise, the minimum deposit (down payment) you need for an investment property in the UK is 25% when using a standard buy-to-let mortgage.

This will be the biggest cost when purchasing buy-to-let properties in the UK.

Other Upfront Purchasing Costs

As well as the down payment of the mortgage you will also have some other upfront purchasing costs for real estate in the UK.

Some can be quite hefty.

Stamp Duty Land Tax

Good old stamp duty.

- If you’re buying property in the UK and it’s over £250,000 (£425,000 if you’re a first-time buyer) then you will have to pay stamp duty on it.

- If you’re buying a property and you already own another one (which you are not selling), then you will pay stamp duty on it regardless of the price starting from 3% on properties up to £250,000

- The rate that you pay for stamp duty depends on the value of the property

These rules apply to UK residents and there are slightly different rules for non-residents as well as for different entities like corporate bodies.

Here’s the government information on stamp duty to stay up to date.

You can use this stamp duty calculator to help you out too.

For most buy-to-let landlords they will most likely already have their own home that they own, so they’ll automatically get put into the stamp duty bracket where you will pay 3% on the first £250,000 of the property value.

As an example…

If you buy a £200,000 buy-to-let property and it is an additional property to where you stay.

You will pay 3% of £200,000 in stamp duty which is £6000.

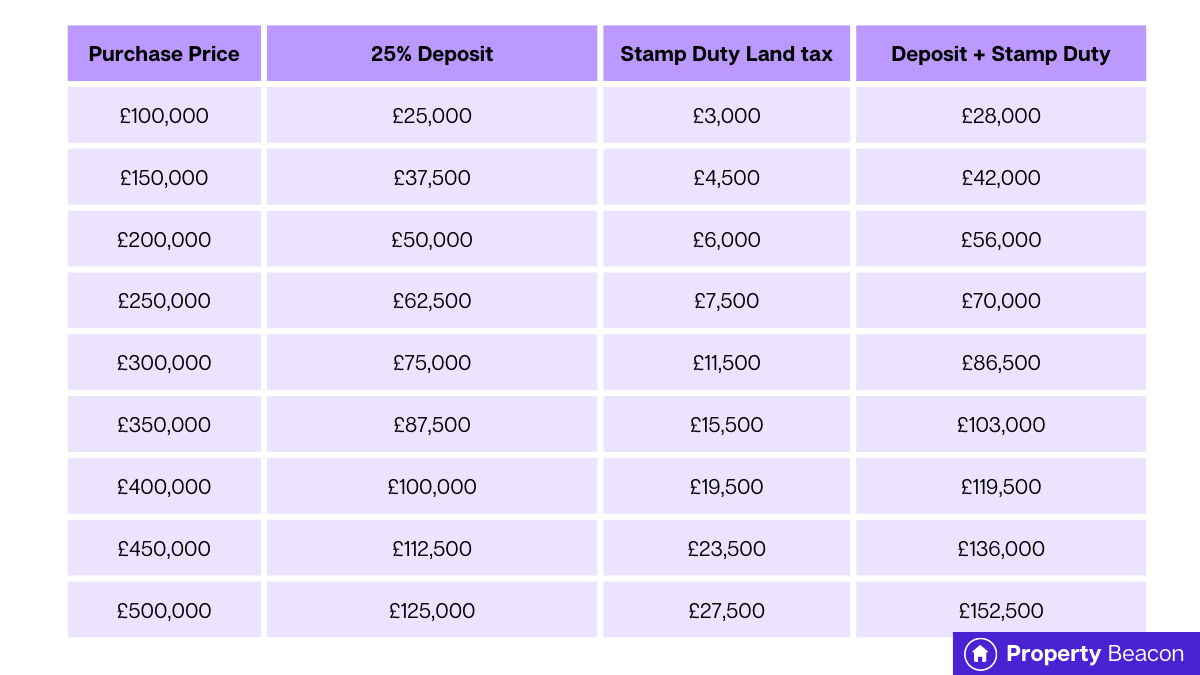

Further in this post I’ve included a table that compares stamp duty amounts to different property values.

Legal Fees

These will generally be between £1000 – £2000 and the price will generally follow the purchase price of the property.

The average solicitor fees for buying a house in the UK (in 2023) are £2,339.

If you are buying a buy-to-let property worth up to £100,000 to £250,000 your total solicitor fees are likely to be closer to the £1600-£2000 range.

This amount includes conveyancing, local searches, and disbursements.

Source data: Compare My Move Solicitor Fees

Refurbishment

This is an optional cost as it depends on the investor and the property being bought.

If you are buying a turnkey property that is ready to let out then you won’t need any money for this.

If you are just putting in new carpets and a new lick of paint you might need a few thousand pounds. (Source data: carpet costs, painting costs)

If you are doing a full BRRR renovation and redoing the whole house, the cost can vary wildly but you’re likely to need £10,000+.

Broker Fees

This only applies if you use a broker.

The broker fee can vary but you’ll typically pay between £300-£600 or 0.35%-1% of the loan amount (mortgage amount) in broker fees.

(Source data: Online Mortgage Advisor Broker Fees)

The cost of broker fees might put some people off but a good broker should more than pay for their fee in getting the perfect mortgage product for your situation.

Surveys

Surveys when buying a home have 3 levels and they can range from £300 up to £1500 depending on the type of survey you get and the property value.

The three main survey types are:

- Rics Level 1 (previously condition report) £300-£900

- Rics Level 2 (previously home buyer survey) £400-1000 *most popular*

- Rics Level 3 (previously full structural survey) £630-£1500

Depending on the property you may also have to get specialist surveys like a damp survey or a dry-rot survey – each of these surveys can be around £300.

If you are buying a very old property in bad condition so you can renovate it, you probably should get a full structural survey so you can be aware of potential costs.

Or don’t, it’s your life.

To recap, surveys when buying a property in the UK can cost on average between £300-£1500.

For properties under £250,000 expect to pay around £300 to £800 with a RICS level 2 survey (most common) costing around £400-£600.

£300 would be for level 1 and £800 would be for level 3.

Source data: How much does a survey cost?

Upfront Costs Examples

So we know the upfront costs of buying a property, but all of these depend heavily on the value of the property meaning we need to know the prices of the properties we’ll be investing in.

Let’s look at a range of property prices and look at the main costs which are fixed and unchanging which are the deposit and stamp duty.

The table below shows the purchase price along with how much you would pay for the deposit and for stamp duty.

In this table, we are assuming that the purchaser already has a home and is buying an additional property. It also assumes they are a UK resident.

Remember that on top of the deposit and stamp duty costs you still need to pay for:

- Legal fees

- Refurbishment (optional)

- Broker Fees (optional)

- Surveys (optional but recommended)

In general, I would estimate £2000-ish for legal fees, (increase this if your property value is higher than £250,000.)

Example Property Deals

Let’s have a look at the numbers of some example property deals to see if we can find a pattern.

Example 1: £106,000 Property Deal

Example 2: £80,000 Property Deal

Example 3: £69,000 Property Deal

Summary of Example Property Deals

So after looking at the 3 example scenarios you can see that the total purchase costs of a buy-to-let property (not including any refurbishments and updates) are about 30% of the purchase price.

If you want to be safe just assume it’s about 31%.

How Much To Buy A £100k Buy-to-Let Property?

You can see from the table earlier that you would need at least £28,000 in funds just to pay your deposit and stamp duty fees on a standard £100k buy-to-let property.

If we follow the guideline of about 30% you’d need at least £30,000 for all upfront purchasing costs.

How Much To Buy A £200k Buy-to-Let Property?

You can see from the table earlier that you would need at least £56,000 in funds just to pay your deposit and stamp duty fees on a standard £200k buy-to-let property.

If we follow the guideline of about 30% you’d need at least £60,000 for all upfront purchasing costs.

How Much To Buy A £300k Buy-to-Let Property?

You can see from the table earlier that you would need at least £86,500 in funds just to pay your deposit and stamp duty fees on a standard £300k buy-to-let property.

If we follow the guideline of about 30% you’d need at least £90,000 for all upfront purchasing costs.

Can you Invest In A UK Property With £10k?

After reading this post you might think that you can’t invest in property in the UK with only £10k.

After all, even if you put all of that money down as a 25% deposit you’d be looking at a purchase price of £40,000.

The only properties that you’d find for that kind of money are probably not worth investing in.

But you can use that £10k to invest in property without buying your own property.

For example, you could invest in REITs where the underlying asset is a portfolio of property.

You could also do a joint venture deal where you partner up with other people, pool your money together and work together to buy an investment property that costs more than you could afford on your own.

You could also get into rent-to-rent. This is where you rent a property from a landlord and guarantee rent for a fixed period of time.

You then refurb the property to a higher standard and rent it out at a higher rent or change it to serviced accommodation or a HMO instead for higher cash flow.

All of this has to be done in compliance with the landlord’s mortgage product though.

Can You Invest In A UK Property With £50k?

You certainly can invest in property with £50k in the UK.

If you live in London you might be laughing at me.

But further north you can find plenty of properties in the £80,000-£200,000 range that are 2-3 bedroom properties. (In good areas too).

To give you an idea the average house price in Liverpool in June 2023 according to Hometrack is £155,700. (source: Home track June 2023)

And remember, the purchase costs of buying a buy-to-let property (not including refurb costs) are around 30% of the purchase price.

So with £50k, you can probably afford a rental property with a purchase price of around £167,000 (£50k is about 30% of £167,000).

Can You Invest In A UK Property With £30k?

Yes, you can, but you will be more limited geographically.

With £30k, you can probably afford to purchase a buy-to-let property for about £100,000 assuming purchase costs amount to around 30% of the purchase price )

Cities in the north of England have plenty of 2-bedroom properties for £100,000 or less.

Remember the two examples earlier in this post that were purchase prices of £69,000 (the Justin Wilkins example) and £80,000 (the Aren Singh example).

Both of these types of deals are fairly common in northern towns and cities in the UK.

I wouldn’t look in the South if you only have £30k to spend though.

Luckily you can invest in property remotely by letting a property manage a property for you even if you are hundreds of miles away.

Conclusion

There are quite a lot of upfront fees when buying an investment property in the UK and it can be expensive.

The main costs in buying rental property are:

- Deposit (about 25% of purchase price)

- Stamp Duty Land Tax (depends on your situation)

- Legal Fees (around £2000 on average)

- Refurbishment (depends)

- Broker Fees (around £300-£600 or 0.35%-1% of loan)

- Surveys (£300- £1500 but £300-£800 for properties under £250,000)

But the biggest unavoidable costs are the deposit and stamp duty (unless you are doing a refurb).

Overall you’ll need about 30% of the purchase price to be able to pay for all of the mandatory upfront purchasing costs (not including any refurbishments).

And these don’t even account for the ongoing costs of having a property like landlord insurance, EPC, gas safety certificates, and other maintenance costs.

Also, remember that house prices vary from area to area and the best way to learn about house prices is to follow house price indices over time.

Some example house price indices include:

- Halifax House Price Index

- ONS (Office for National Statistics) House Price Index

- Zoopla / Hometrack (this is free but you need to sign up to it with your email.)

- HM Land Registry / HPI

- Nationwide HPI

- Rightmove Asking Price Index

Related reading: Guide to UK House Price Indices

If you think that it’s too much money to invest in property in the UK and you’re just a bit unsure you should read the following post: