What Is A House Price Index?

A house price index is made to track house prices over time and see how trends are changing.

This is useful in giving you an idea of where the current housing market is and potentially in what direction the market is moving.

E.g. You may have a different strategy as a property investor depending on whether you think the market is currently flat, falling, or rising, and a house price index helps you assess this.

There is more than one house price index for the UK and these house price indices/indexes differ in what they measure.

*Note: The indexes we are looking at today are all for residential properties and not for commercial properties.

What Matters? + Quick Summary

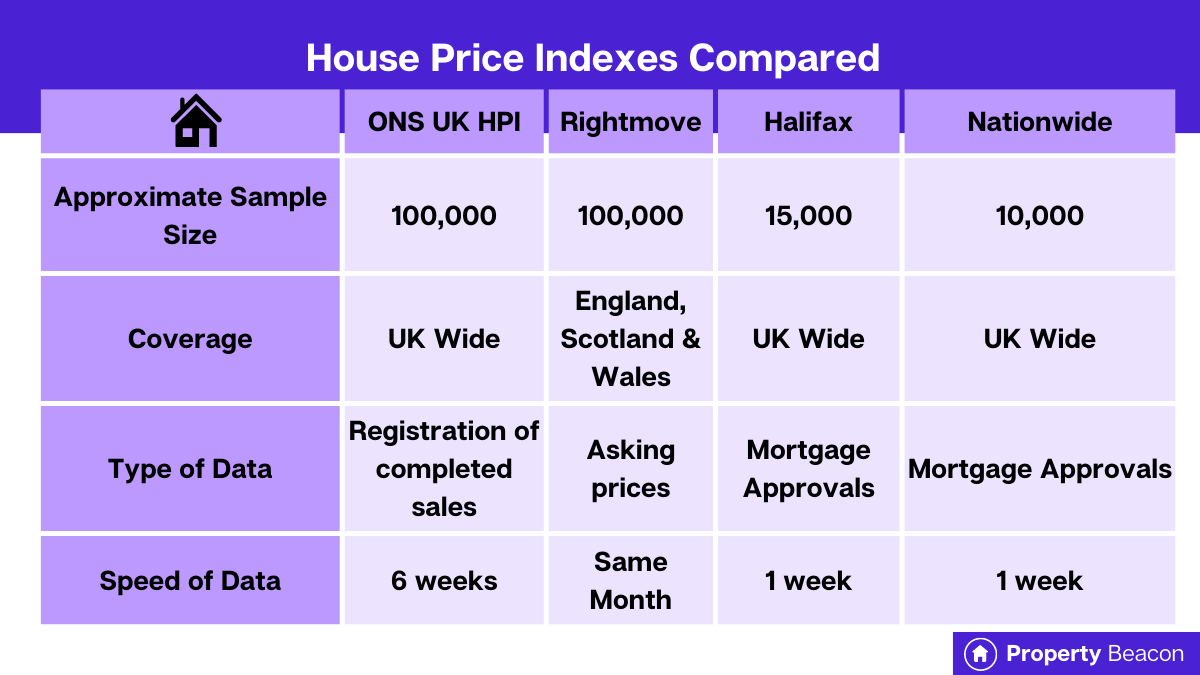

When looking at house price indexes the main things that matter are:

- Sample size

- Coverage

- Type of data

- Speed of data

Here’s a very quick summary table of the main house price indexes in the UK and some of the features compared.

The rest of this post goes into this table in a bit more detail but to give you a quick overview here’s how you could use the different indexes.

- Use Rightmove asking prices as a leading indicator for the direction of house prices

- Use Halifax HPI as a leading indicator for all sold prices

- Use UK HPI (ONS) as your final, most accurate data

What House Price Indexes Are There?

In the UK there are a few different house price indices that people use, so it can be confusing to know which one is best.

Here are the main house price indices in the UK that people use:

- Land Registry UK HPI / ONS

- Halifax House Price Index

- Nationwide House Price Index

- Rightmove Asking Price index

Some people also like to look at the Zoopla / Hometrack house price index.

What Is The Most Accurate House Price Index?

Overall in terms of accuracy, the UK HPI is the most accurate house price index in the UK (we’ll also refer to this one as the ONS HPI at some points in this post).

The UK HPI (House Price Index) that is published by the ONS is a joint publication of the HM Land Registry, Land and Property Services Northern Ireland, Office for National Statistics and Registers of Scotland.

The UK HPI is a very reliable and accurate index because it has a very large dataset (registered sales in the UK).

It includes every property sale that is registered whether that’s in cash or through a mortgage and measures about 100,000 transactions a month (there are some data exclusions).

It is also the main house price index that looks at completed sales data rather than just asking prices or mortgage approvals.

Even though the UK HPI may be the most accurate when it comes to actual prices, all of the indexes are good at showing trends in prices over the long term.

What Is The ONS House Price Index Based On?

The official UK HPI is based on registered sales in the UK and this includes both cash and mortgaged houses.

The best thing about the UK HPI is that the data is based on completed sales that have been registered on:

- HM Land Registry for properties in England and Wales

- Registers of Scotland for properties in Scotland

- Land and property services for properties in Northern Ireland

Quick Overview of ONS UK HPI

- Sample size – Roughly 100,000 transactions a month

- Coverage – All of the UK

- Type of data – Registration data from one of the 3 UK land registering bodies

- Speed of data – about 6-8 weeks after the month in question

- (e.g. June data released around mid-August.

How Accurate Is The UK HPI?

The UK HPI is very accurate as a house price index.

It covers both cash and mortgaged sales and it also uses data based on completed sales.

It also has a much larger dataset than the likes of Halifax or Nationwide as it looks at all registered sales (with some exclusions).

Although, since land registry data can take a while to come through, the data is provisional on release and is revised in the following months as more completion data comes through.

Benefits of the UK HPI

Since they are completed sales it is a very accurate measure of the actual prices that are being paid for houses.

The fact that it includes both cash and mortgaged sales also makes it more accurate as the other main house price indexes ignore cash sales.

It also has one of the largest datasets making it more accurate.

Drawbacks of the UK HPI

The main drawback of the UK HPI is that there is a delay in reporting compared to other indices.

There is also the problem that sales can take a long time to be fully registered so sales can feed into the data a few months after the initial report for a month.

So the initial report for a given month is provisional and is updated over time to include any delayed data.

What Is The Rightmove House Price Index Based On?

The Rightmove House Price Index is actually based on Asking prices on its platform and not actual sold prices.

Since Rightmove has around 86% market share for online property listings, it has a pretty good sample size to work from.

Quick Overview of Rightmove Asking Price Index

- Sample size – Up to 200,000 transactions a month (normally around 100,000)

- Coverage – England, Scotland and Wales

- Type of data – Asking prices of Rightmove listings

- Speed of data – Same month as data

- June data released in June

How Accurate is Rightmove Asking Price Index?

Depends on what you mean by accurate.

On one hand, the Rightmove Asking Price is factually accurate in the sense that it is taking actual asking prices from listings on its platform.

As mentioned earlier it also has a very sizable market share so it covers almost all property listings in the UK.

In this sense, you definitely get an accurate measure of asking prices in the UK and the direction that they are heading in.

On the other hand, it is inaccurate for actual sold prices in the housing market.

This is because asking prices are just that, asking prices. The final sale of a property is often above or below the asking price.

If it is a really hot market, then the price that a house sells for is often quite above the asking price.

In a slow market, the price that a house sells for is often a discount off the asking price.

Another thing to consider is that if a house has an asking price that is too high but doesn’t sell, this Rightmove listing will still end up in the asking price index.

Benefits of using Rightmove Asking Price Index

A benefit of Rightmove’s Asking Price Index is how quickly the data is available.

It’s practically instant as Rightmove can just pull data from live listings on its platform.

It can also give you an idea of sentiment in the market.

E.g. If asking prices are going up in consecutive months, then it can suggest that the market is heating up and people are feeling confident about house prices continuing to go up.

Another benefit is that the sample size is really large. Rightmove has over 80% of the market share of property listings, so almost all property listings are listed on Rightmove.

This makes it a very reliable indicator for asking prices across the country.

Drawbacks of using Rightmove asking price index

As we said earlier asking prices are not the same as sold prices and listings that don’t end up being sold will still be included in this index.

This means it’s not an accurate measure of the actual prices of houses.

Another drawback is that Rightmove uses an arithmetic mean which means it can be skewed more heavily by the more expensive properties for sale.

On the other hand, the UK HPI, Halifax HPI and the Nationwide HPI all use a geometric mean. For house prices, a geometric mean is a better method to use.

This is one reason why the Rightmove index is basically always higher than the other house price indexes.

What Is The Halifax House Price Index Based On?

The Halifax house price index is based on mortgage approvals across its customer base.

This means that any properties purchased through bridging loans or cash won’t be part of the index.

Halifax is part of Lloyds banking group which provides 19.5% of all mortgages in the UK, and Nationwide provides about 12% of the UK mortgage market. (Source: UK Finance)

This is the largest market share of any mortgage lender in the UK, so it is a pretty large sample size.

Quick Overview of Halifax House Price Index

- Sample size – around 10,000-15,000 transactions (19.5% of UK mortgage approvals)

- Coverage – UK-wide

- Type of data – Mortgage approvals data from Halifax / Lloyds banking group

- Speed of data – Within 1 week of the data period finishing

- E.g. June data published in the first week of July

How Accurate Is The Halifax House Price Index?

In terms of the data it does include, you can argue it’s a better measure of house prices than the Rightmove index because it is based on mortgage approvals rather than asking prices.

Mortgage approvals aren’t always based on the final sale price of a property, but they will be much closer on average than the asking prices.

So it’s a fairly accurate way of seeing what people are paying for houses.

As an example let’s compare June 2023 data between the ONS UK HPI and the Halifax HPI.

- Halifax HPI

- June 2023 Average House Price = £286,011

- ONS UK HPI

- June 2023 Average House Price = £288,000

You can see that based on June 2023 the data is very close and the average house price is within 1% of each other.

However, just like Rightmove, it does not take into account any property sales that have fallen through before completion.

It also won’t take into account any sales completed with bridging finance or cash.

Benefits of the Halifax House Price Index

The major benefit of the Halifax house price index is that there isn’t much of a delay from the data being collected to the data being reported.

For example, data for August would be released about a week into September. This means you only need to wait a week after a given month to get an idea of the house prices.

Drawbacks of the Halifax House Price Index

One drawback of the Halifax House Price Index is the sample size and the type of data.

It only includes mortgaged property sales and no cash sales, so a sizeable chunk of sales are not included.

On top of this, it only represents Halifax’s own mortgage data which is less than 20% of the whole UK mortgage market.

While this is a sizeable sample, it doesn’t compare to the ONS HPI which has data on a lot more transactions.

What Is The Nationwide House Price Index Based On?

Similar to the Halifax House price index the Nationwide House price index is based on its own mortgage approvals.

I.e. No cash sales or bridging finance sale will be included and it does not take into account that some mortgage approvals will end up being for sales that have fallen through.

In terms of timeliness, the Nationwide HPI is released within a few days of the end of the month.

So like the Halifax index, you can get the data pretty quickly.

The Nationwide index takes into account properties across the whole of the UK.

Quick Overview of Nationwide House Price Index

- Sample size – around 6,000-10,000 transactions (around 12% of UK mortgage approvals)

- Coverage – UK-wide

- Type of data – Mortgage approvals data from Nationwide

- Speed of data – Within 1 week of the data period

- E.g. June data published in the first week of July

How Accurate is the Nationwide House Price Index?

Let’s compare nationwide data to the UK HPI data from the ONS for a given month.

As an example let’s compare June 2023 data between the ONS UK HPI and the Nationwide HPI.

- Nationwide HPI

- June 2023 Average House Price = £262,239

- ONS UK HPI

- June 2023 Average House Price = £288,000

You can see from the above data that the Nationwide HPI gives a house price that is £25,761 less (or 9.8% less) than the UK HPI.

Since we see the UK HPI as the most accurate index you could argue that the Nationwide is not that accurate (unless you feel that the methodology used by Nationwide is the best).

In contrast, the Halifax HPI seems to follow the UK HPI closer in recent years.

Benefits of the Nationwide House Price Index

Similarly to the Halifax index, the main benefit of the Nationwide index is that there is little delay from data collection to data reporting.

Drawbacks of the Nationwide House Price Index

The drawbacks of the nationwide index are pretty much the same as the Halifax index, as they both only include mortgaged sales and only use their own mortgage approvals data.

This means cash sales are left out of the index and only a fraction of the mortgage market is looked at.

Another downside is that the Nationwide Index also excludes all buy-to-let data and only looks at owner-occupier mortgages instead.

In the case of Nationwide, they make up around 12% of the UK mortgage market so if anything they are less representative than Halifax as Halifax has more data to draw from.

Which Should I Use As A Property Investor?

As a property investor, you should probably use all of the indexes to make judgments on the current and future market.

However, for historical data, the UK HPI is best as it has the largest data set and time delays become less important.

For example, if you were trying to look at house prices over the last 25 years, then I would use the ONS UK HPI.

Use asking price indexes alongside the Nationwide and Halifax indexes to get a feel of where asking prices are in relation to sales.

If asking prices are going down, but sale prices are still going up it could suggest that sale prices will be dropping in the not-too-distant future.

On the flip side, if sale prices are flat or going down, but asking prices are starting to go up then it could suggest sale prices will follow.

Remember that the ONS / Land registry numbers are going to give you the best estimate of ACTUAL house prices because it has the most data, it’s just the slowest to report.

While the Land registry data should probably be the benchmark for the most accurate data, it’s also the slowest one to come out, so it’s best to at least consider data from other indexes.

But also remember to look at local data and not just the national averages.

Some cities can have growing house prices while others have falling house prices.