When you look around online everyone assumes you use a 25% deposit for buy-to-let property investments.

But what about when interest rates shoot up?

You could be in a situation where your cash flow goes negative and you have to pay out of pocket or risk the lender wanting to repossess your house.

But what if you just upped your deposit from 25% to 30%?

Would that help?

Let’s dive in, but first here’s a quick summary for those that don’t want to read the whole thing…

- Mortgage choices – Slightly more choices on offer for a 30% deposit

- Interest rates – About the same for both 25% and 30% buy-to-let mortgages

- Acquisition cost – A 30% deposit is 20% bigger than a 25% deposit, so it will take 20% longer to save the deposit

- Interest payments – Over 25 years, interest payments will be higher on a 25% deposit even if the interest rate is the same.

- Stress tests – You’re more likely to pass stress tests with a 30% deposit.

- Rental revenue – This doesn’t change based on the deposit you use, but the rental profit is better if you use a 30% deposit.

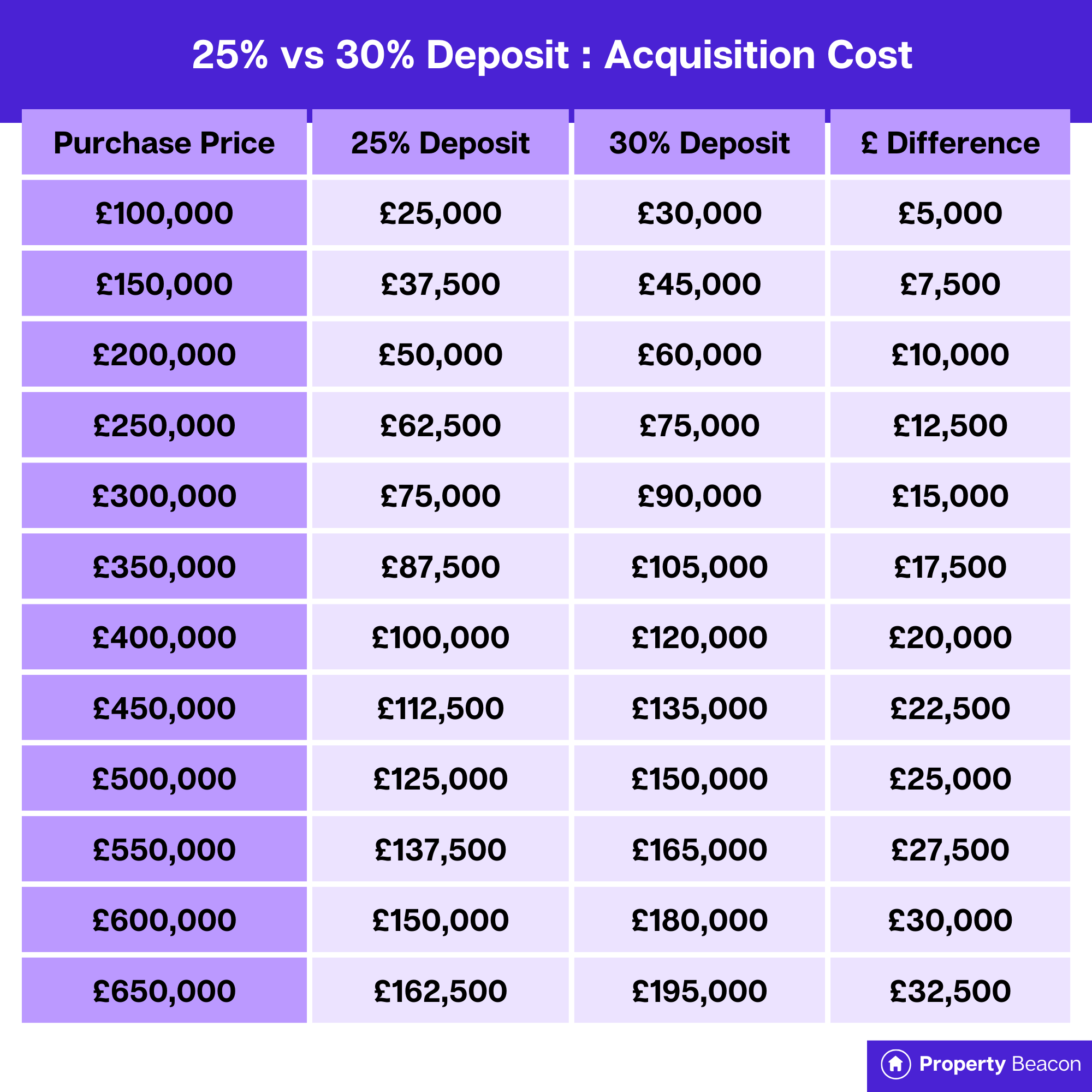

Acquisition Cost

If you saved the same amount every month for a deposit it would take you 20% more time to save for a 30% deposit compared to a 25% deposit.

Here’s a table comparing the deposit you would pay if you put down 25% vs 30% from properties valued at £100,000 up to £650,000.

How much longer does it take to save for a 30% deposit?

- If it took you 1 year to save a 25% deposit, it would take an extra 2.4 months to save for a 30% deposit.

- If it took you 2 years to save a 25% deposit, it would take an extra 4 months to save a 30% deposit.

- If it took you 3 years to save a 25% deposit, it would take an extra 6 months to save a 30% deposit.

Differences in Mortgage Products

Choice

First of all, you will have less choice with a 25% deposit because some lenders only start lending at a 70% loan-to-value (30% deposit).

For example:

At the time of writing (September 2023), Halifax (the UK’s largest mortgage provider) doesn’t do a buy-to-let mortgage with a 25% deposit.

Their lowest deposit amount for a buy-to-let is 30%, you can’t even get a buy-to-let mortgage with Halifax unless you have a 30% deposit.

However, this can change depending on market conditions.

Generally, most lenders will be happy to lend up to 75% of the property’s value, but there will be some lenders who want a slightly higher deposit.

Interest Rates and Payments Over 25 Years

Let’s have a look at some live mortgage products now to see if there’s any big difference in interest rates.

We’ll look at a property worth £300,000 as it’s an easy number to work with.

We’re going to keep this extremely simple just to demonstrate.

Today’s date is 15th September 2023, so if you’re reading this in 2027 then that’s why the rates might look so different to what you’re seeing.

Here’s what we did…

- We went to MoneyFactsCompare and went to their buy-to-let mortgages.

- We entered our deposits on a £300,000 property as follows:

- £210,000 for a 30% deposit (70% LTV)

- £225,000 for a 25% deposit (75% LTV)

- We then sorted the results by ‘cost over’ so it sorts by the amount you pay over the term of the mortgage.

- We picked the first result for both the 25% deposit and the 30% deposit.

Assumption: We are assuming you never change the mortgage product by remortgaging just to keep it simple.

Here are the results:

For 30% Scenario

A TSB Fixed mortgage was first on the list with the following representative example:

Total amount payable £746,531.00 includes loan amount, interest of £519,486, valuation fees of £0 and product fees of £1995. The overall cost for comparison is 9.3% APRC representative.

For 25% Scenario

A TSB Fixed mortgage was first on the list with the following representative example:

Total amount payable £696,900.00 includes loan amount, interest of £484,855, valuation fees of £0 and product fees of £1995. The overall cost for comparison is 9.3% APRC representative.

The Differences

In both examples above the interest rate is the same at a 5.79% fixed for the first 28 months and then switching to the variable rate of 9.59%.

Both have a 9.3% APRC.

The only difference is that the payments over the term are less for the 30% deposit because you’re paying the same interest rate on a smaller loan amount.

The interest rates on offer were the same when comparing a 30% to a 25% deposit in this scenario.

- In the 30% scenario, you pay £484,855 in interest payments.

- In the 25% scenario, you pay £519,486 in interest payments

You pay a total of £34,631 more in interest payments over the mortgage term if you use a 25% deposit in this example.

Here are a few more examples…

This time we used the same purchase price and deposits, but sorted the mortgage products by lowest APRC and then looked at the top 5 products that showed up.

30% Deposit (70% LTV)

Top 5 products sorted by APRC:

- 7.0% Skipton

- 7.0% Skipton

- 7.1% Newcastle

- 7.2% Newcastle

- 7.6% Godiva

25% Deposit (75% LTV)

Top 5 products sorted by APRC:

- 7.0% Skipton

- 7.0% Skipton

- 7.1% Newcastle

- 7.2% Newcastle

- 7.6% Godiva

You can see here that there was no difference in the interest rates on offer between using a 25% vs a 30% deposit.

While this quick test shows that interest rates don’t really change, the fact that there will be more options for you at 70% LTV (30% deposit), means that you are more likely to find a deal that has other terms that are more favourable to your situation.

Remember that the interest rate isn’t everything and you need to consider other parts of the mortgage product.

Related Reading: Compare different interest rates using this interest-only mortgage calculator

Payments Over 25 years

Let’s look at the payments over 25 years with a 7% APRC.

Interest Payments Over 25 years

Over 25 years on an interest-only mortgage, assuming you never remortgage and you pay an APRC of 7.0%, here’s what you end up with:

- £393,750 in interest payments when using a 25% deposit

- £367,500 in interest payments when using a 30% deposit

- You pay £26,250 more (7.14% more) in interest payments over 25 years

So your deposit is £15,000 more but you save £26,250 in interest payments.

Yearly Interest Payments

Yearly you pay the following with an APRC of 7%:

- £15,750 when using the 25% deposit

- £14,700 when using the 30% deposit

- You pay £1,050 more per year when using a 25% deposit

Monthly Interest Payments

Monthly you pay the following with an APRC of 7%:

- £1,312.50 when using the 25% deposit

- £1,225 when using the 30% deposit

- You pay £87.50 more per month when using a 25% deposit

Capital Growth

Let’s look at house prices in a 25-year period to see how we could fair with capital growth.

We’ll use the most recent land registry data we have at the moment which is from June 2023.

Going back 25 years we end up in June 2008.

- In June 2008 the average UK house price was £181,831.

- In June 2023 the average UK house price was £287,546.

- That’s an average increase of 58% in that 25-year period.

We’ll just use this number to see what the differences in capital growth could be if the same kind of capital growth occurred over the next 25 years.

Capital Growth On A £300,000 Property

Assuming house prices go up 58% the same £300,000 house would be worth around £474,000 after 25 years.

25% Deposit

If you paid a 25% deposit of £75,000, you would have a mortgage of £225,000.

If you sold the house you could repay the original mortgage and pocket £174,000.

£474,000 (new value) – £75,000 (deposit paid) – £225,000 (original mortgage) = £174,000

30% Deposit

If you paid a 30% deposit of £90,000, you would have a mortgage of £210,000.

If you sold the house you could repay the original mortgage and pocket £189,000.

£474,000 (new value)- £75,000(deposit paid) – £210,000(original mortgage) = £189,000

So you could be about £15,000 (or about 8.6%) better off in terms of capital growth if you use the 30% deposit in this example.

Stress Testing

If you can’t pass your lenders’ stress tests you won’t even be able to get the mortgage.

A 30% mortgage will always help in passing a buy to let stress test because you have lower interest payments meaning your rent does not have to be as high.

Let’s use an example.

If the interest coverage ratio is 125% this means that the market rent needs to be 125% of the interest payment.

- If you have an interest payment of £1,225 on a 30% deposit you will need to find a property that can be rented out for at least £1,531 per month.

- If you have an interest payment of £1,312.50 on a 25% deposit, then you will need to find a property that can be rented out for at least £1,641.

This means you’d need to find a property that can perform better by at least £110 on the rental market in this scenario, just because you have a smaller deposit.

So using a higher deposit gives you more options when picking properties as you can get away with slightly lower market rents to pass buy-to-let stress tests.

Rental Profit Over 25 years

The average UK monthly rent in August 2023 was £1,261 according to the Homelet rental index.

The average UK house price in August 2023 was £279,569 according to the Halifax HPI.

This makes the average UK rental yield around 5.4% in August 2023.

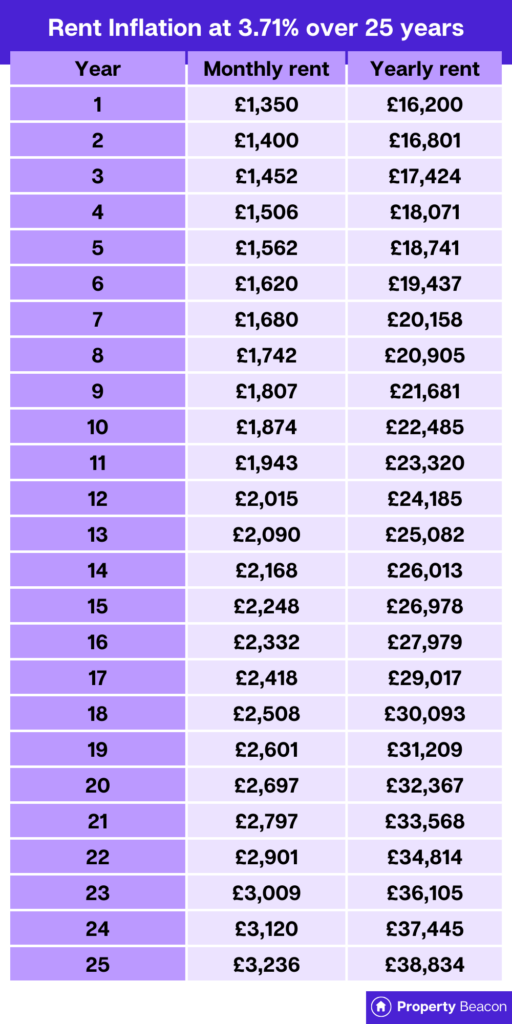

If we assume the same for our £300,000 property in our example, that gives a monthly rent of £1,350 and a yearly rent of £16,200.

So we have our starting point, but how much do rents go up every year.

Well according to Trading Economics, rental inflation between 1989 and 2023 averaged around 3.71% annually.

That means in year 1 you make £1,350 per month and £16,200 per year, but with annual rental inflation of 3.71%, by year 25 you make around £3,236 per month and £38,834 per year.

See the graphic below for a breakdown of how rental inflation could play out at 3.71% annually for 25 years.

Obviously, it’s not going to be 3.71% every single year as this is just an average.

Some years it will be lower and in other years it will be higher.

Either way, the increase in average market rent would happen regardless of the deposit you put down.

So the amount of rent you can achieve isn’t affected by the deposit you have, but the amount of profit is.

This is because you will be paying less in interest every month on the 30% deposit scenario (meaning a greater difference between your interest payment and your rental revenue).

Another thing to note is that over time the difference between your rental revenue and your interest payments keeps getting larger and larger.

This is because your rents go up over time but the original loan stays the same.

Which in turn means your rental profits go up over time too.

In year 1 you get £1,350 in rent per month.

But by year 10 you get around £1,874 in rental payments per month and still pay the same amount in interest.

Rental revenue over 25 years doesn’t change whether you use a 25% or 30% deposit.

But you do make more rental profit as your interest payments will be lower on a 30% deposit.

Opportunity Cost

So a 30% deposit will give you higher profits overall but what about the opportunity cost?

When you go for a 30% deposit it means you’re foregoing the opportunity to use that extra 5% for something else and not buying a property earlier.

Remember it takes 20% longer to save for a 30% deposit.

In that time you could buy a property and have it start earning rental profits and capital growth for you.

The longer it takes you to save the more you should consider this.

Imagine it takes you 5 years to save for a 25% deposit, and then it takes another year to get up to 30%.

In that additional year, you could have bought a property and started earning rental profits which could help you in getting your next property quicker.

The Verdict

So what does it look like overall?

- Mortgage choices – Slightly more choices on offer for a 30% deposit

- Interest rates – about the same for both 25% and 30%

- Acquisition cost – a 30% deposit is 20% bigger than a 25% deposit, so it will take 20% longer to save the deposit

- Interest payments – over 25 years will be higher on a 25% deposit even if the interest rate is the same. (because the interest is on a higher loan amount)

- Stress tests – You’re more likely to pass stress tests with a 30% deposit.

- Rental revenue – This doesn’t change based on the deposit you use, but the rental profit is better if you use a 30% deposit.

Further Reading

Here are some useful articles you might also like: